As the new year approaches, Medicare beneficiaries are preparing for changes to their coverage and costs. One aspect of Medicare that can significantly impact premiums is the Income-Related Monthly Adjustment Amount (IRMAA). In 2025, the IRMAA brackets will undergo changes, affecting how much certain Medicare beneficiaries pay for their Part B and Part D coverage. In this article, we will delve into the 2025 Medicare IRMAA brackets, explaining what they mean for you and how you can navigate these changes to make informed decisions about your Medicare coverage.

Understanding IRMAA Brackets

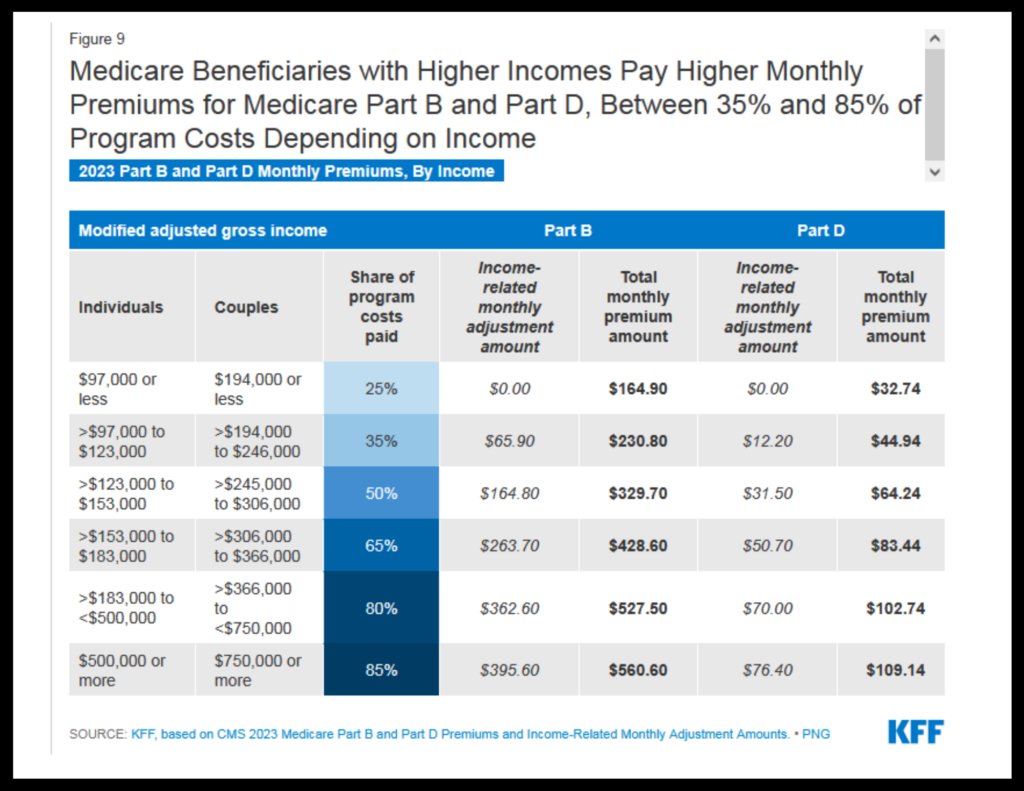

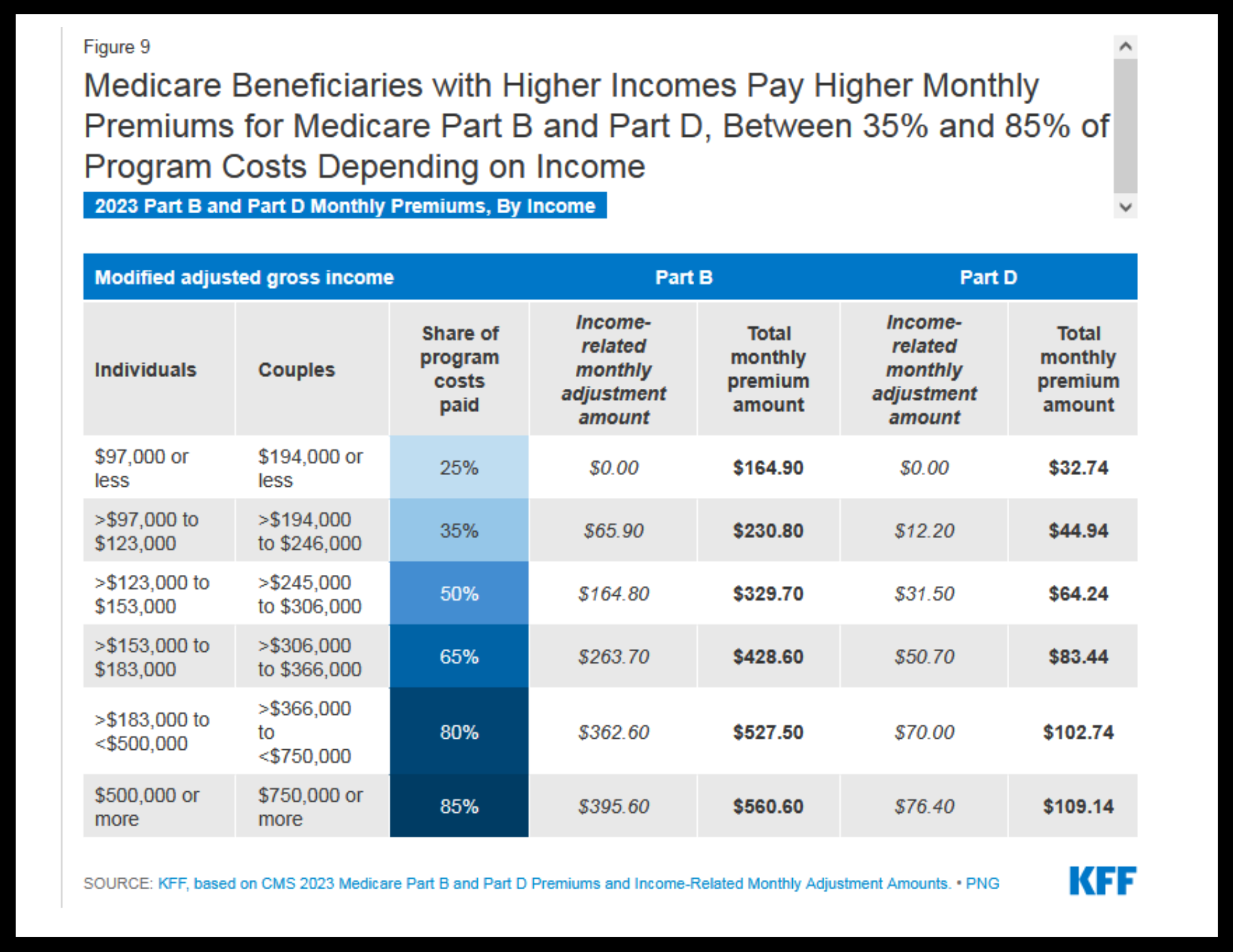

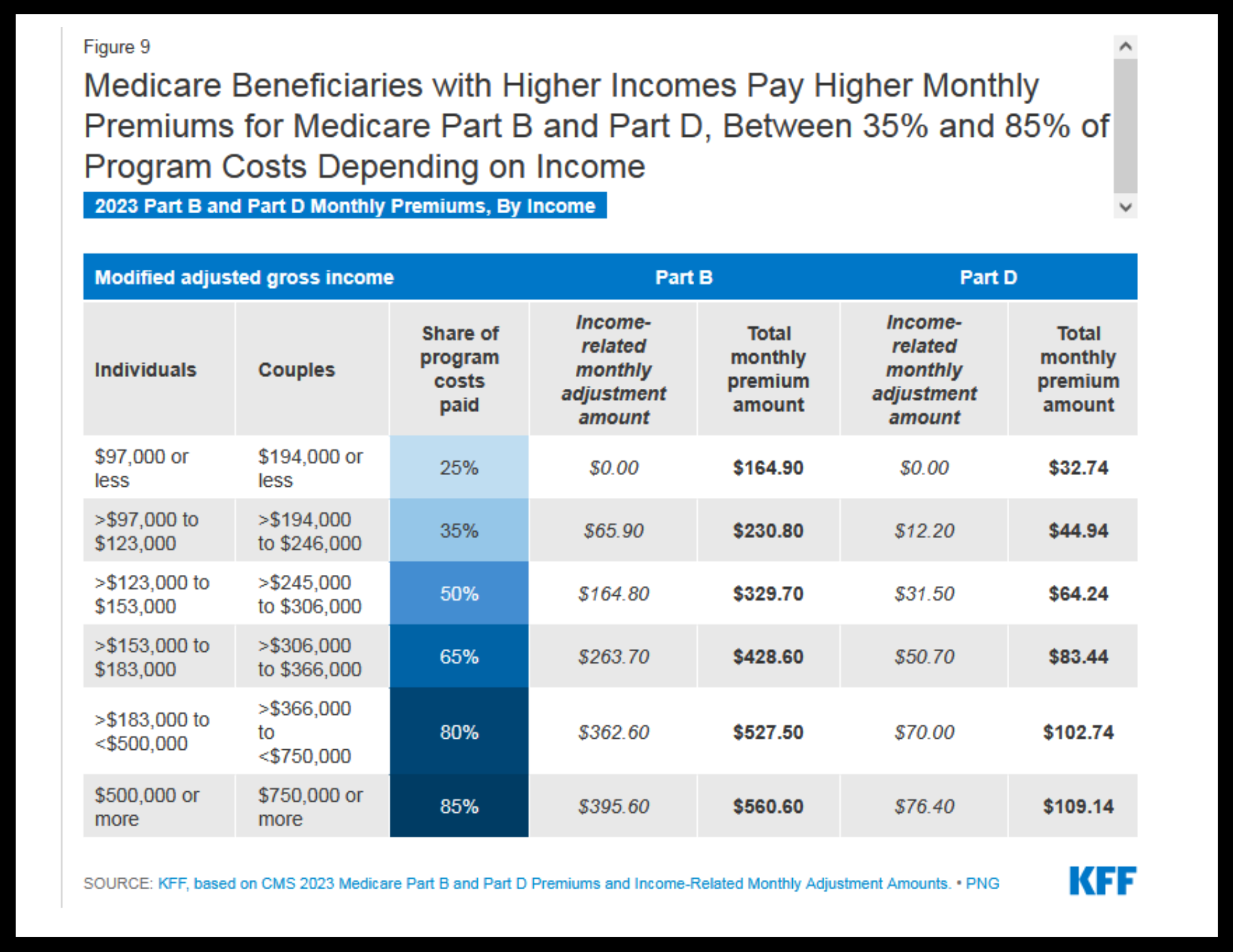

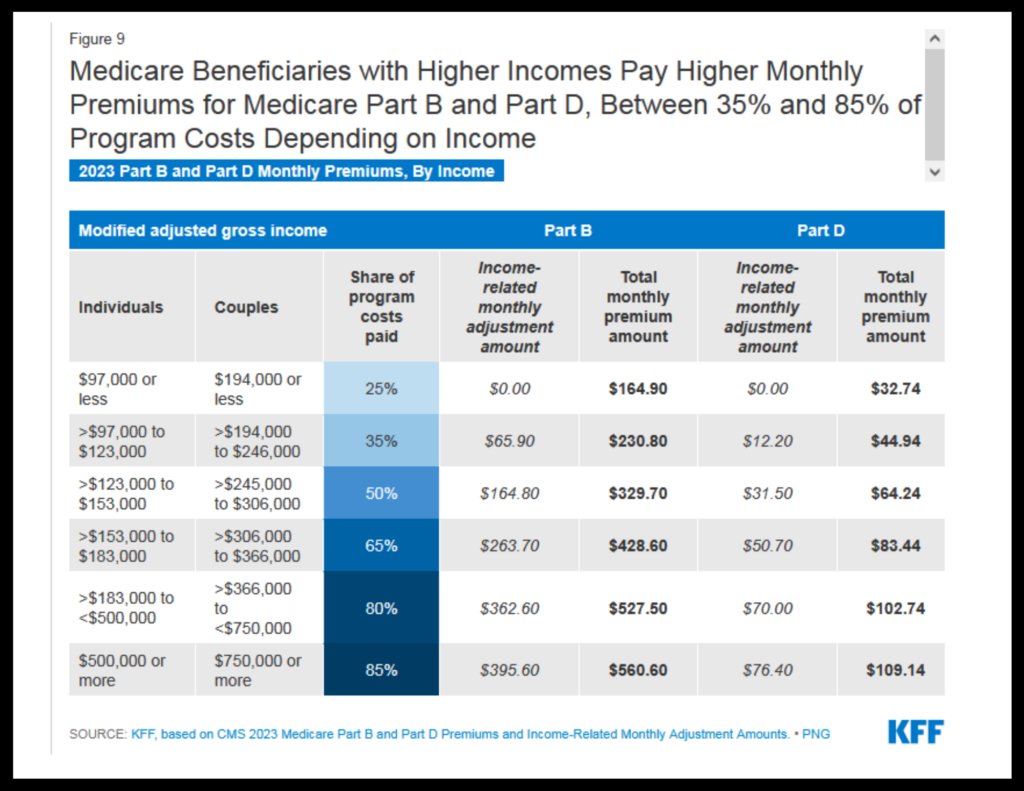

The IRMAA is an adjustment made to Medicare Part B and Part D premiums based on income. The Social Security Administration (SSA) uses tax returns from two years prior to determine an individual's or couple's income level and apply the corresponding adjustment. The brackets are designed to ensure that higher-income beneficiaries contribute more to the Medicare program, reflecting their ability to pay.

2025 IRMAA Brackets

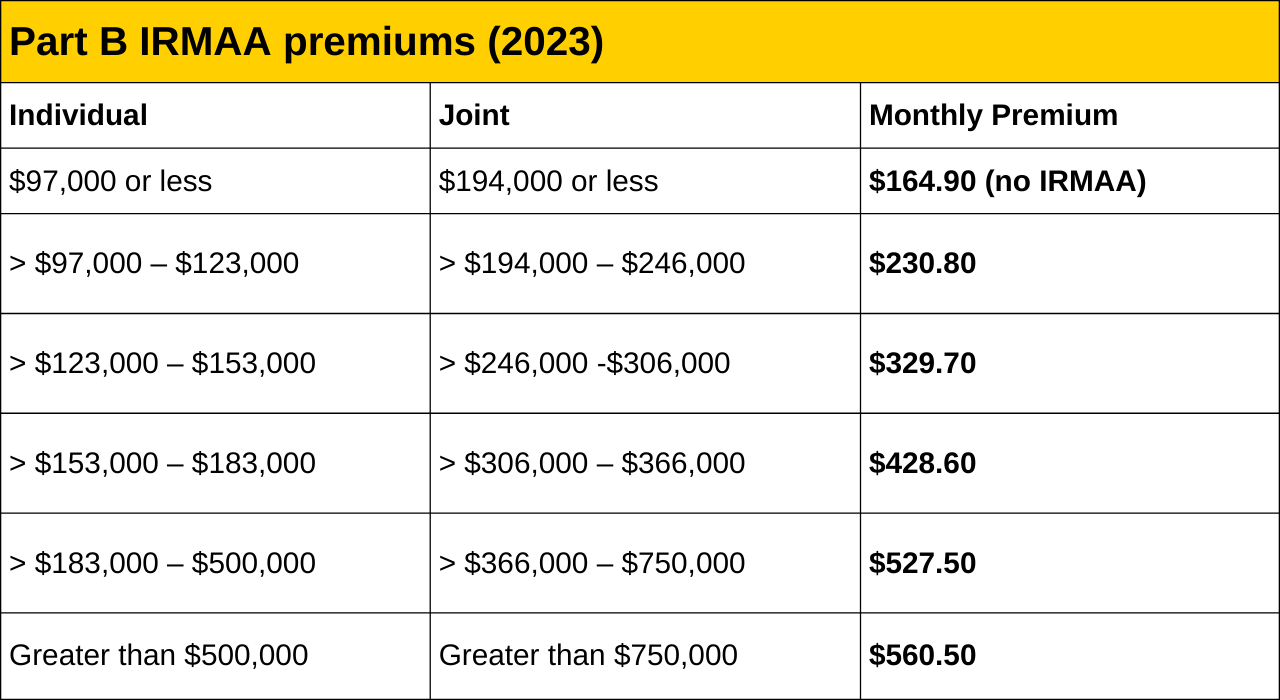

The 2025 IRMAA brackets have been adjusted to reflect changes in the cost of living and to ensure the sustainability of the Medicare program. The new brackets are as follows:

- For individual taxpayers with incomes below $97,000 and joint taxpayers with incomes below $194,000, there is no IRMAA surcharge.

- For individual taxpayers with incomes between $97,001 and $123,000 and joint taxpayers with incomes between $194,001 and $246,000, a surcharge applies.

- The surcharge increases in increments as income rises, with the highest surcharge applying to individual taxpayers with incomes above $503,000 and joint taxpayers with incomes above $759,000.

Impact on Premiums

The IRMAA surcharge can significantly increase the cost of Medicare Part B and Part D premiums. For example, in 2025, the standard Part B premium is expected to be around $164.90 for those not subject to IRMAA. However, individuals or couples in higher income brackets could see their premiums increase by $65.90 to $395.60 per month, depending on their income level.

Navigating the Changes

To navigate the 2025 Medicare IRMAA brackets effectively, beneficiaries should first review their current income and how it might affect their Medicare premiums. It's also crucial to understand that the SSA uses tax returns from two years prior, so 2023 income levels will determine 2025 IRMAA surcharges. Beneficiaries who experience a significant reduction in income due to retirement, divorce, or other life events may be able to appeal their IRMAA determination.

The 2025 Medicare IRMAA brackets are designed to ensure that Medicare remains financially sustainable by adjusting premiums based on beneficiaries' income levels. Understanding these brackets and how they affect your premiums can help you make informed decisions about your Medicare coverage. Whether you're approaching eligibility or already enrolled, being aware of the IRMAA surcharges and how to navigate them can help manage your healthcare costs effectively. As the healthcare landscape continues to evolve, staying informed about changes to Medicare and other healthcare programs is essential for protecting your financial and health well-being.

By planning ahead and understanding the implications of the IRMAA brackets, you can ensure that you're prepared for any changes to your Medicare premiums and make the most of your healthcare coverage in 2025 and beyond.