As a Medicare beneficiary, it's essential to understand the costs associated with your healthcare coverage. One crucial aspect of Medicare is the Income-Related Monthly Adjustment Amount (IRMAA), which affects the premiums you pay for Medicare Part B and Part D. The HI 01101.020 IRMAA Sliding Scale Tables, available on

socialsecurity.gov, provide a clear breakdown of these costs. In this article, we'll delve into the world of IRMAA Sliding Scale Tables and explore how they impact your Medicare expenses.

What is IRMAA?

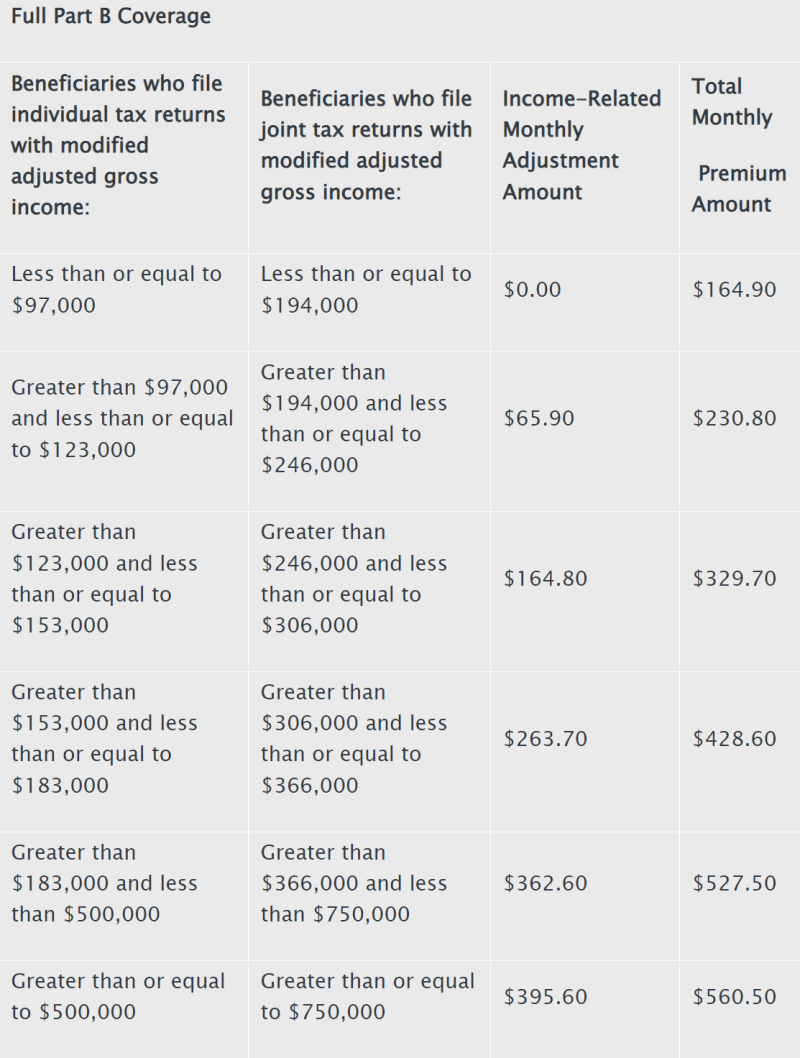

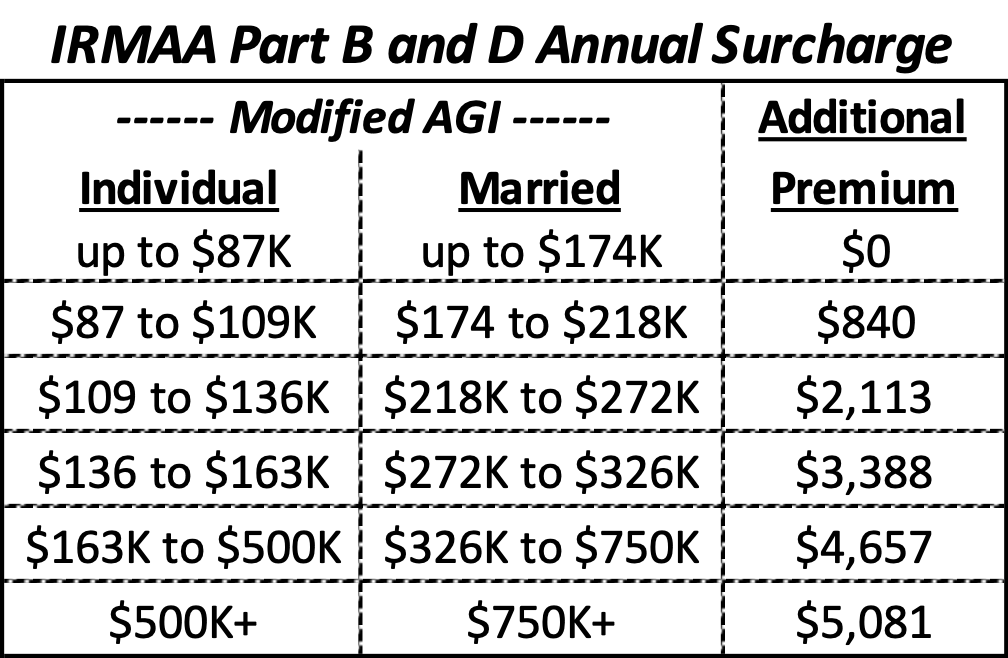

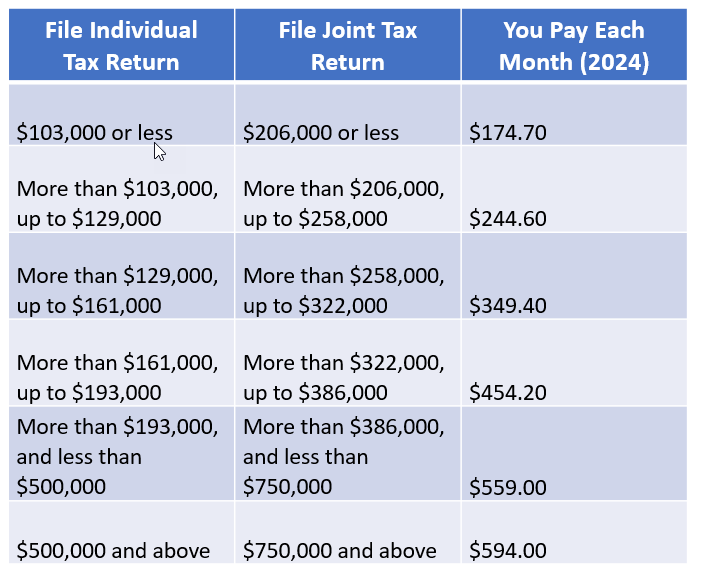

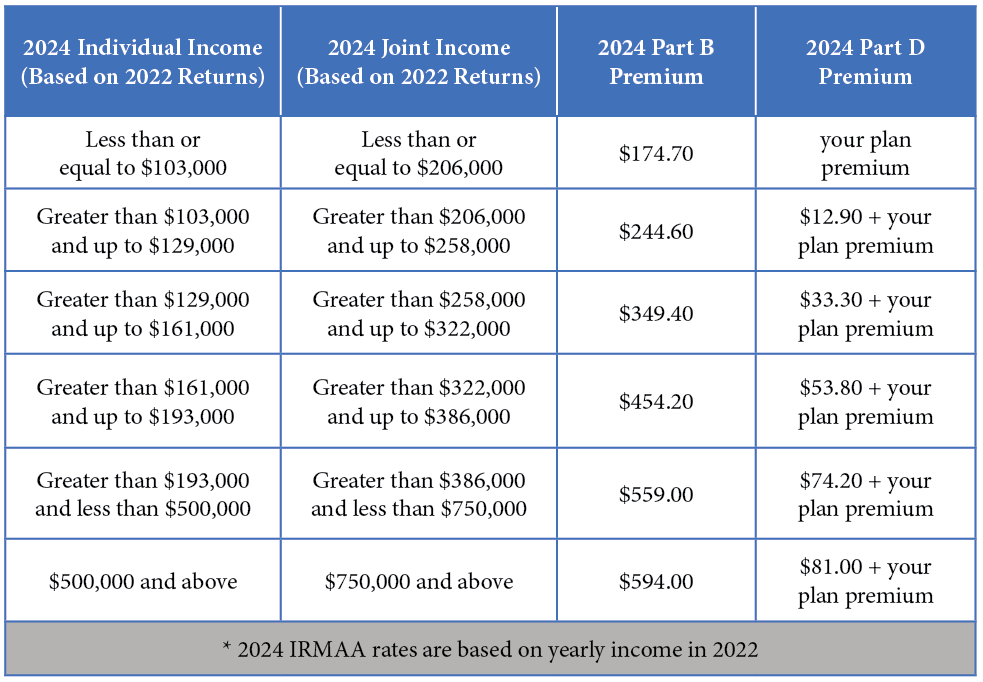

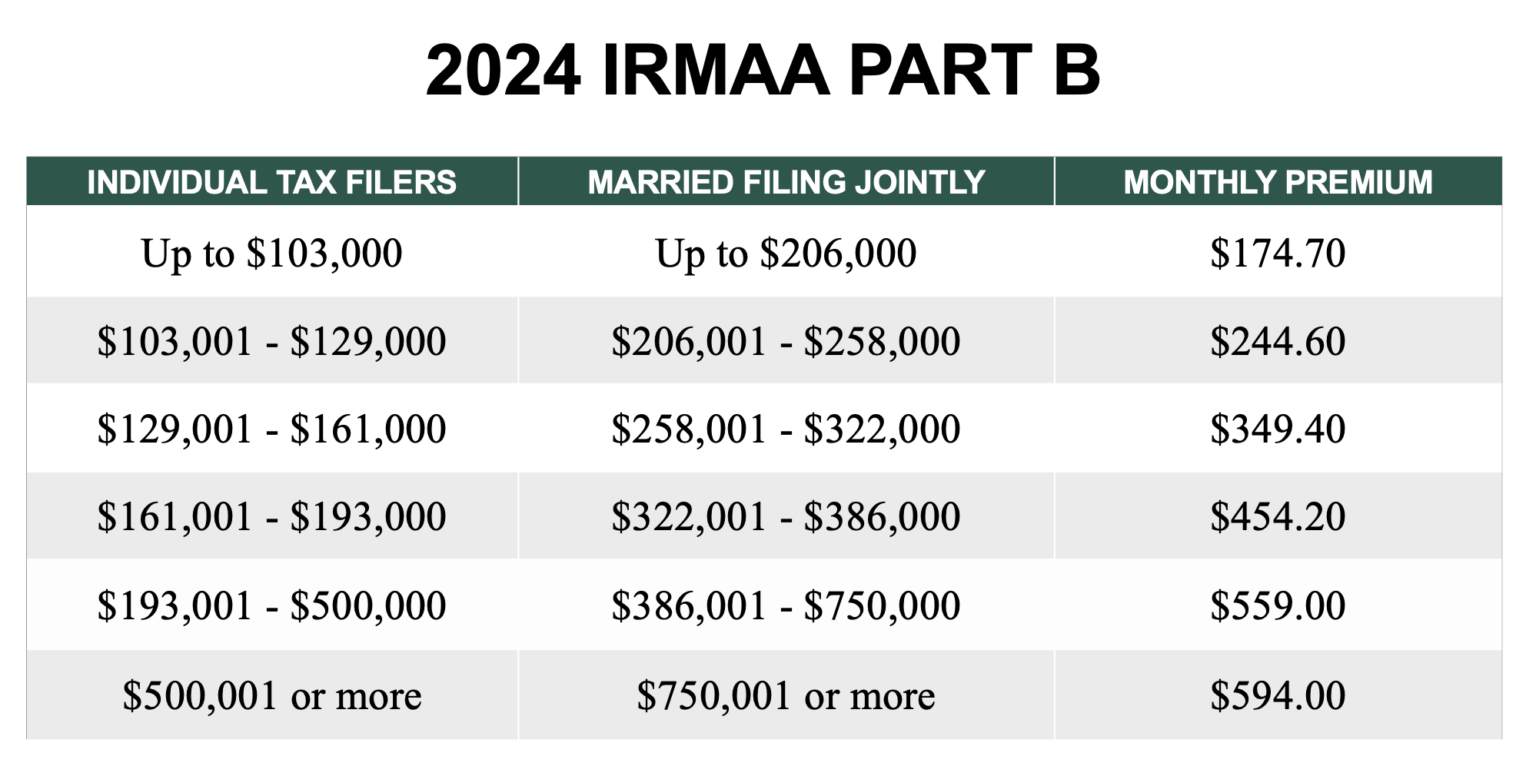

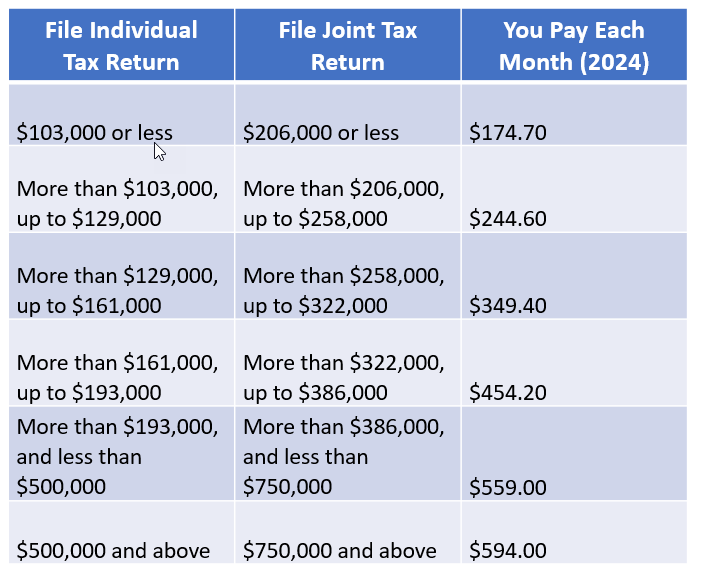

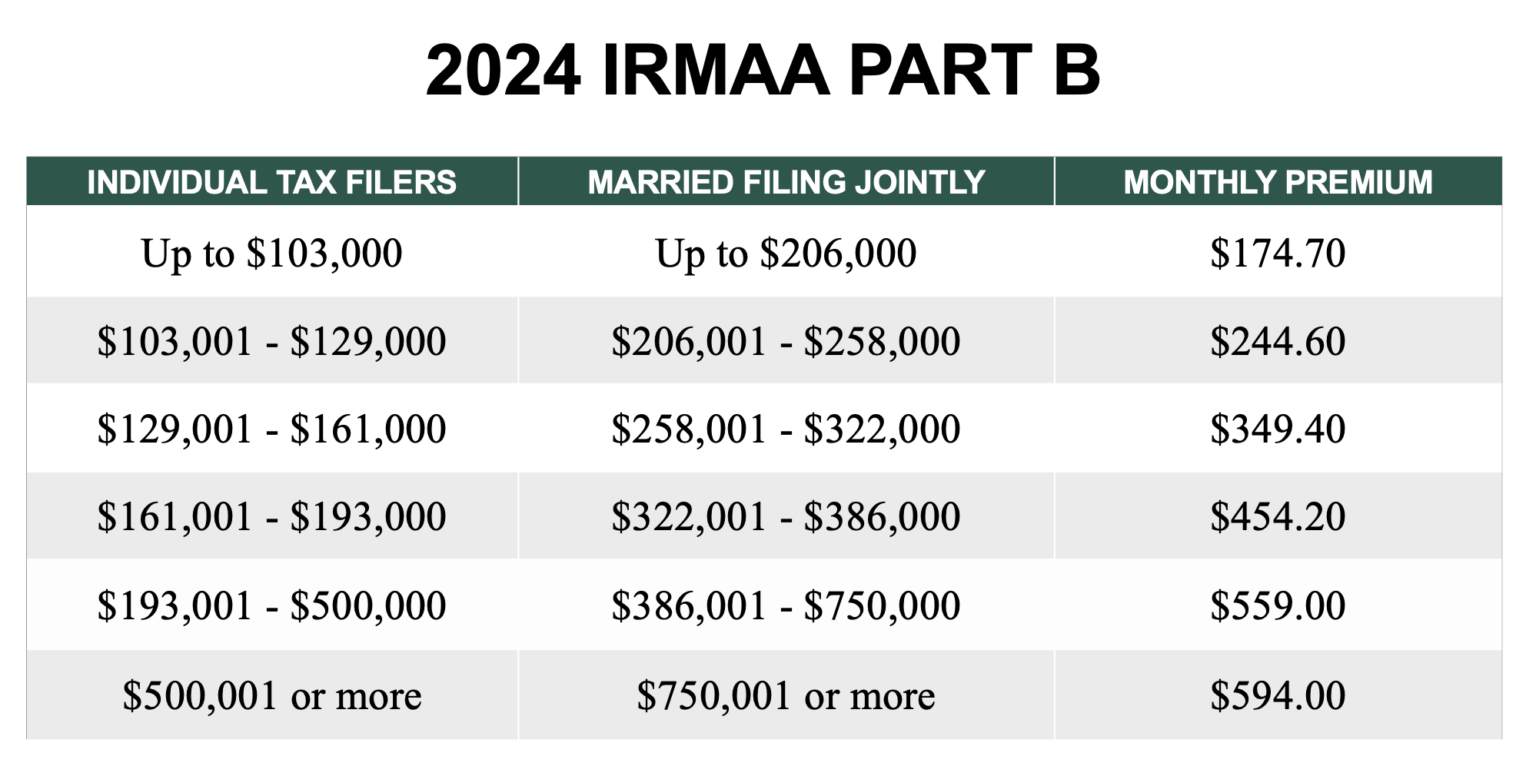

IRMAA is a monthly adjustment amount that's added to your Medicare Part B and Part D premiums if your income exceeds certain thresholds. The amount is based on your modified adjusted gross income (MAGI) from two years prior. For example, if your MAGI in 2022 was above a certain threshold, you'll pay a higher premium in 2024.

How do IRMAA Sliding Scale Tables work?

The IRMAA Sliding Scale Tables, found on

socialsecurity.gov, provide a detailed breakdown of the IRMAA amounts based on your income level. The tables are divided into several tiers, each with a corresponding IRMAA amount. The higher your income, the higher the IRMAA amount you'll pay. For instance, if you're single and your MAGI is between $88,001 and $111,000, you'll pay an IRMAA amount of $59.40 per month for Medicare Part B.

Key Takeaways from the HI 01101.020 IRMAA Sliding Scale Tables

The IRMAA Sliding Scale Tables apply to Medicare Part B and Part D premiums.

The tables are based on your modified adjusted gross income (MAGI) from two years prior.

There are several tiers, each with a corresponding IRMAA amount.

The higher your income, the higher the IRMAA amount you'll pay.

How to Use the IRMAA Sliding Scale Tables

Using the IRMAA Sliding Scale Tables is straightforward. Simply follow these steps:

1. Determine your MAGI from two years prior.

2. Visit

socialsecurity.gov and access the HI 01101.020 IRMAA Sliding Scale Tables.

3. Find your income level in the tables and note the corresponding IRMAA amount.

4. Add the IRMAA amount to your Medicare Part B and Part D premiums to get your total monthly cost.

Understanding the IRMAA Sliding Scale Tables is crucial for Medicare beneficiaries who want to manage their healthcare costs effectively. By visiting

socialsecurity.gov and exploring the HI 01101.020 IRMAA Sliding Scale Tables, you can get a clear picture of your Medicare expenses and plan accordingly. Remember, the IRMAA amount is based on your income level, so it's essential to review the tables annually to ensure you're aware of any changes to your premiums.

By following the guidelines outlined in this article and using the IRMAA Sliding Scale Tables, you'll be better equipped to navigate the complex world of Medicare costs and make informed decisions about your healthcare coverage.