The Income-Related Monthly Adjustment Amount (IRMAA) is a crucial aspect of Medicare that affects the premiums for Part B and Part D coverage. The IRMAA is based on the beneficiary's income, and it's essential to understand how it works to avoid any financial surprises. In this article, we'll delve into the PDF income brackets and surcharge amounts for Part B and Part D IRMAA, providing you with a comprehensive guide to navigate the system.

What is IRMAA?

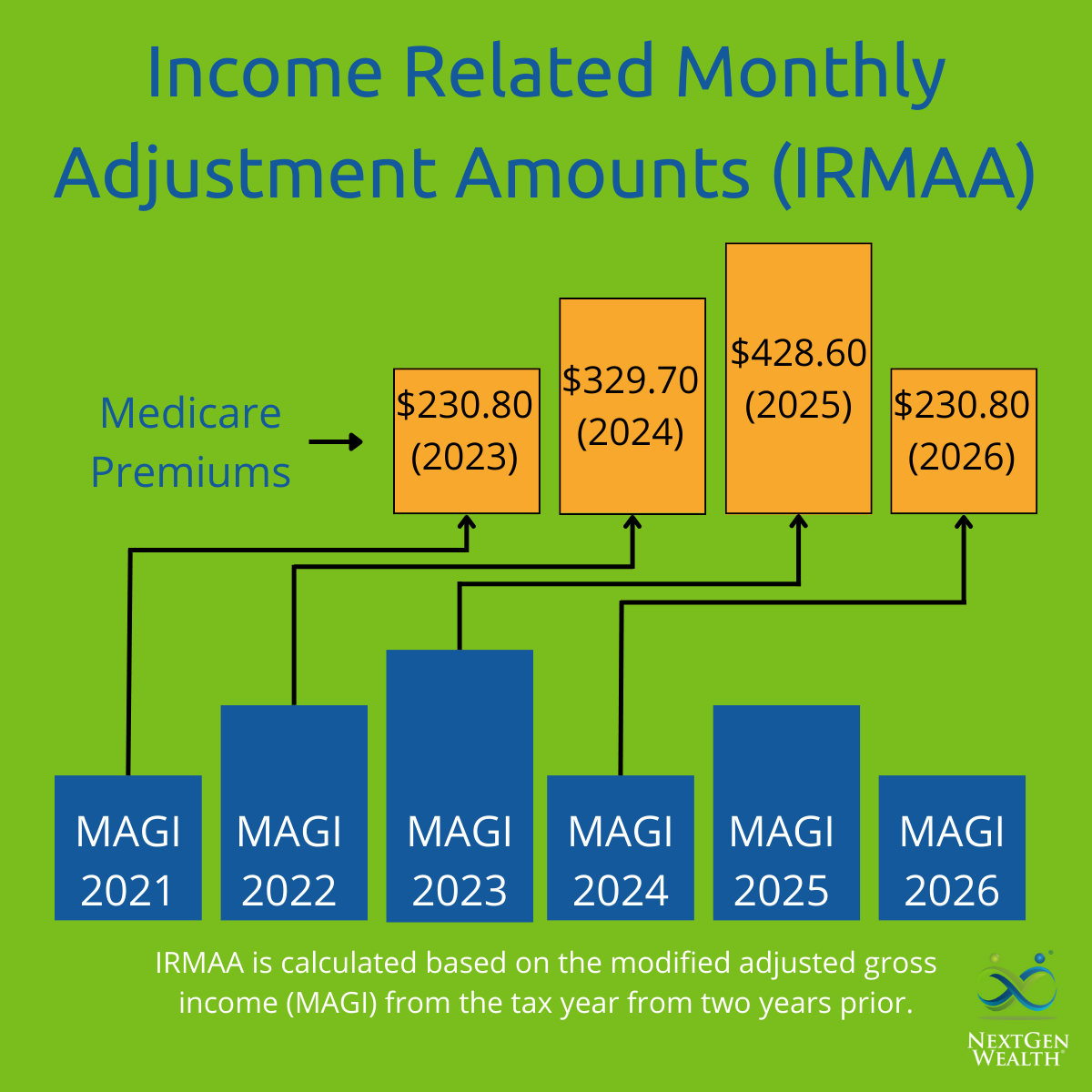

IRMAA is a surcharge added to the premium costs of Medicare Part B and Part D for beneficiaries with higher incomes. The surcharge is calculated based on the beneficiary's Modified Adjusted Gross Income (MAGI) from two years prior. The IRMAA is designed to ensure that higher-income individuals contribute more to the Medicare program, helping to sustain its financial stability.

PDF Income Brackets for IRMAA

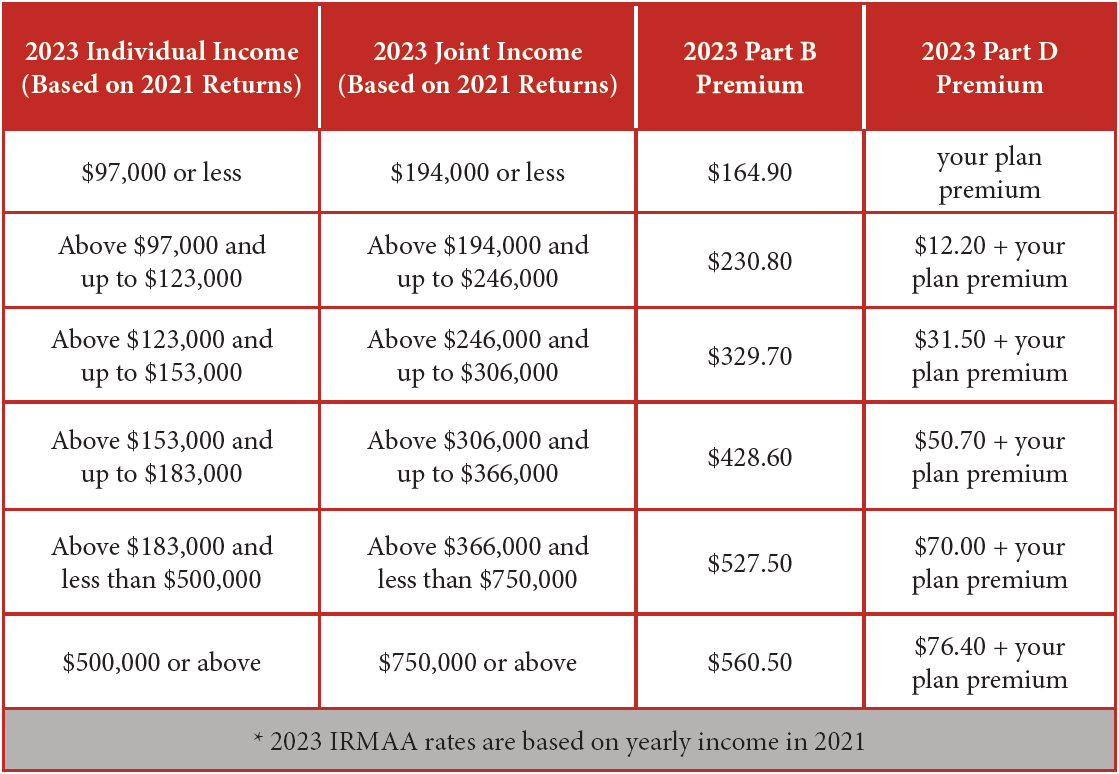

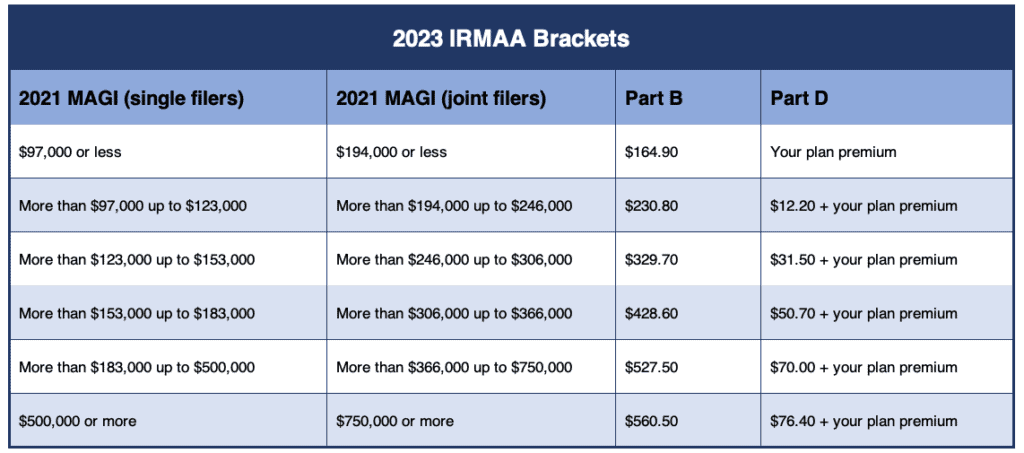

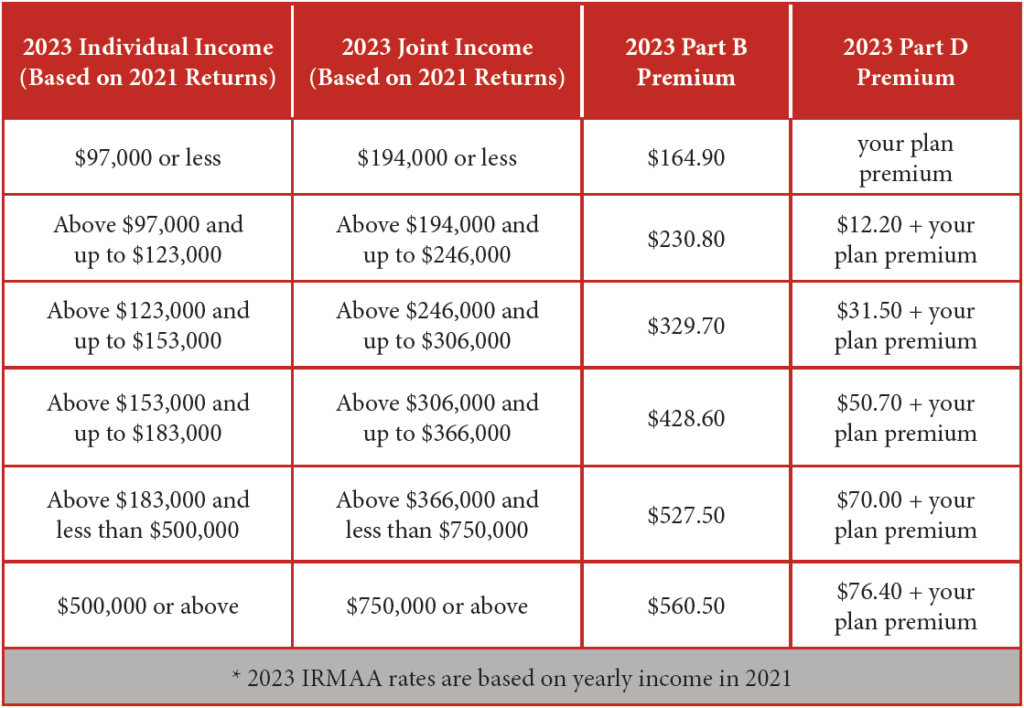

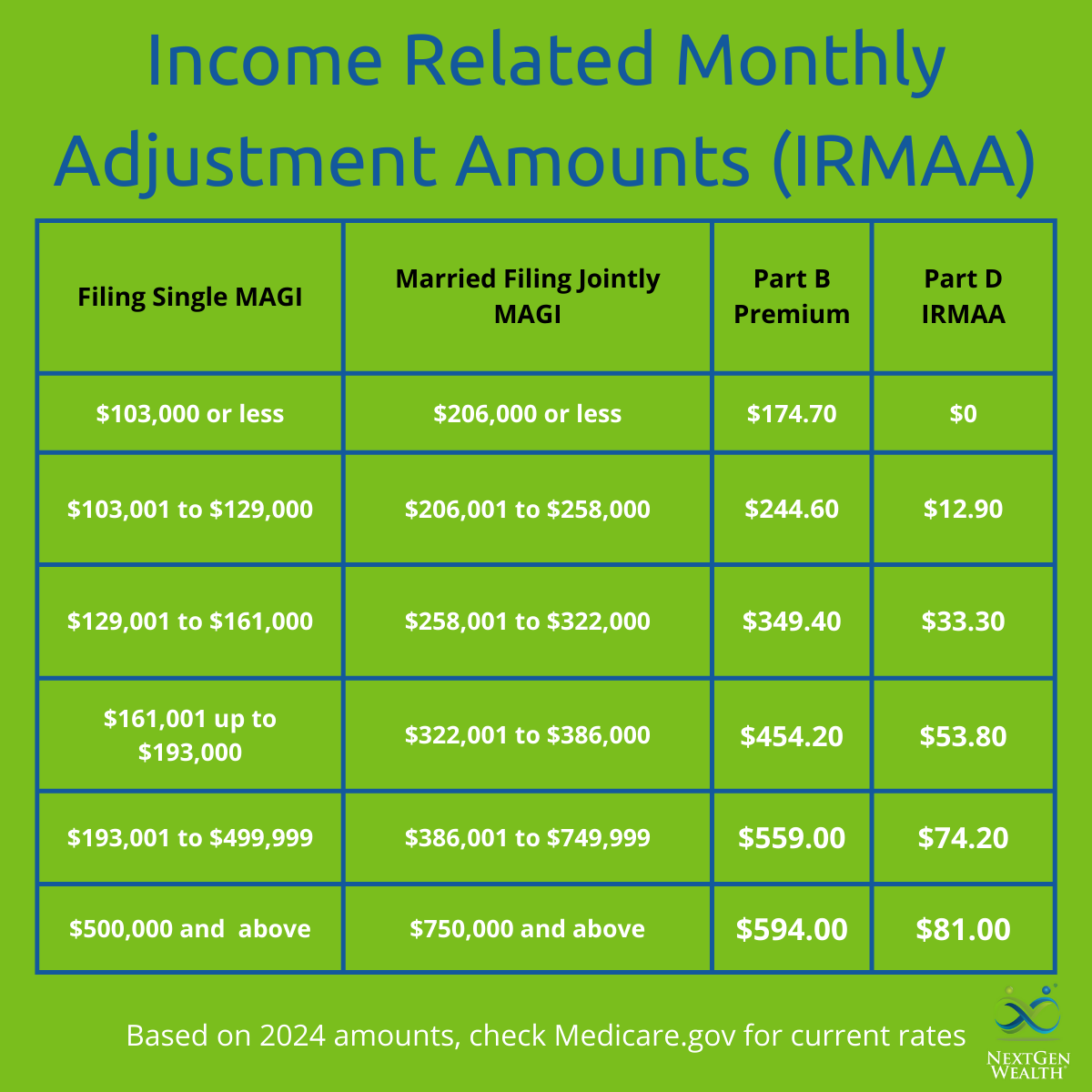

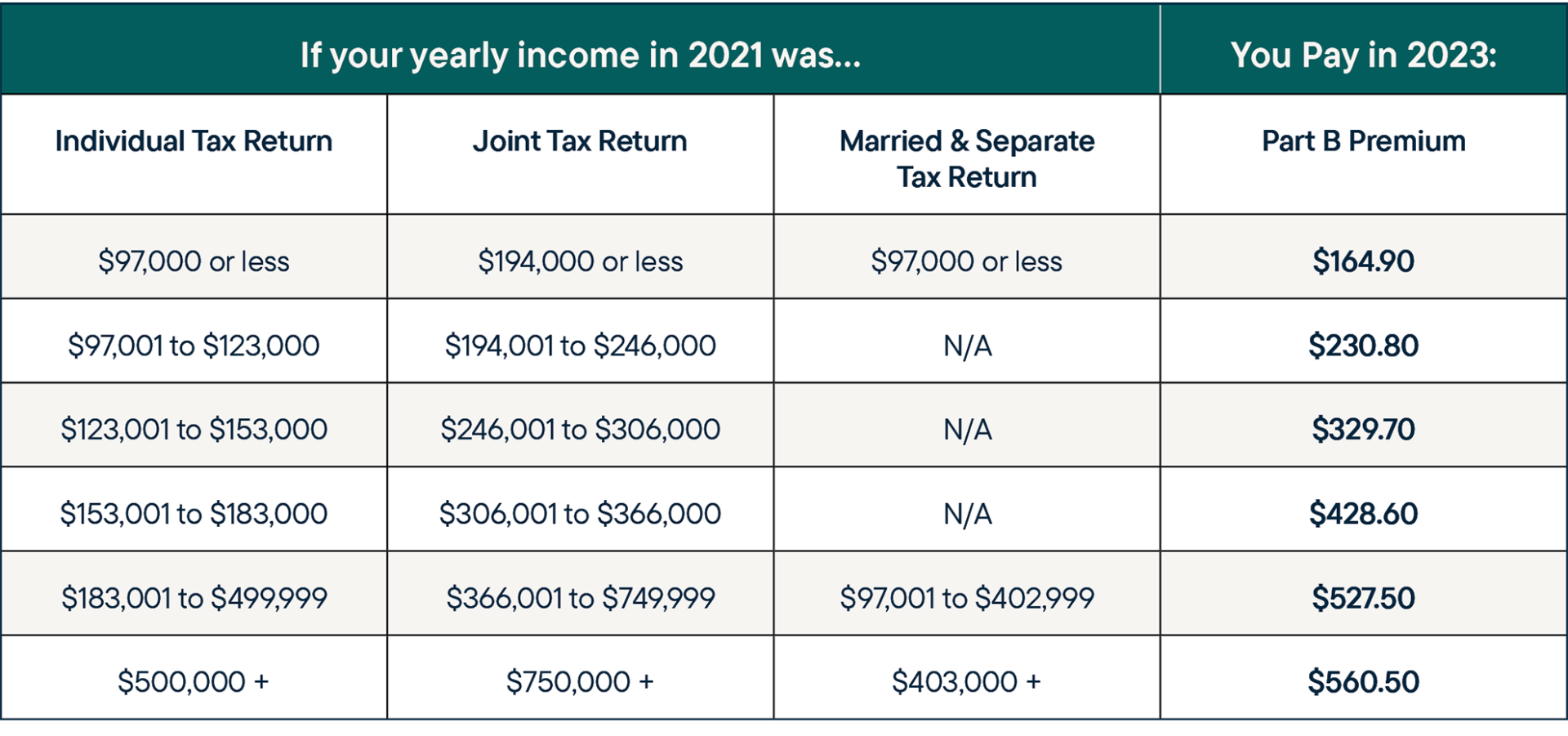

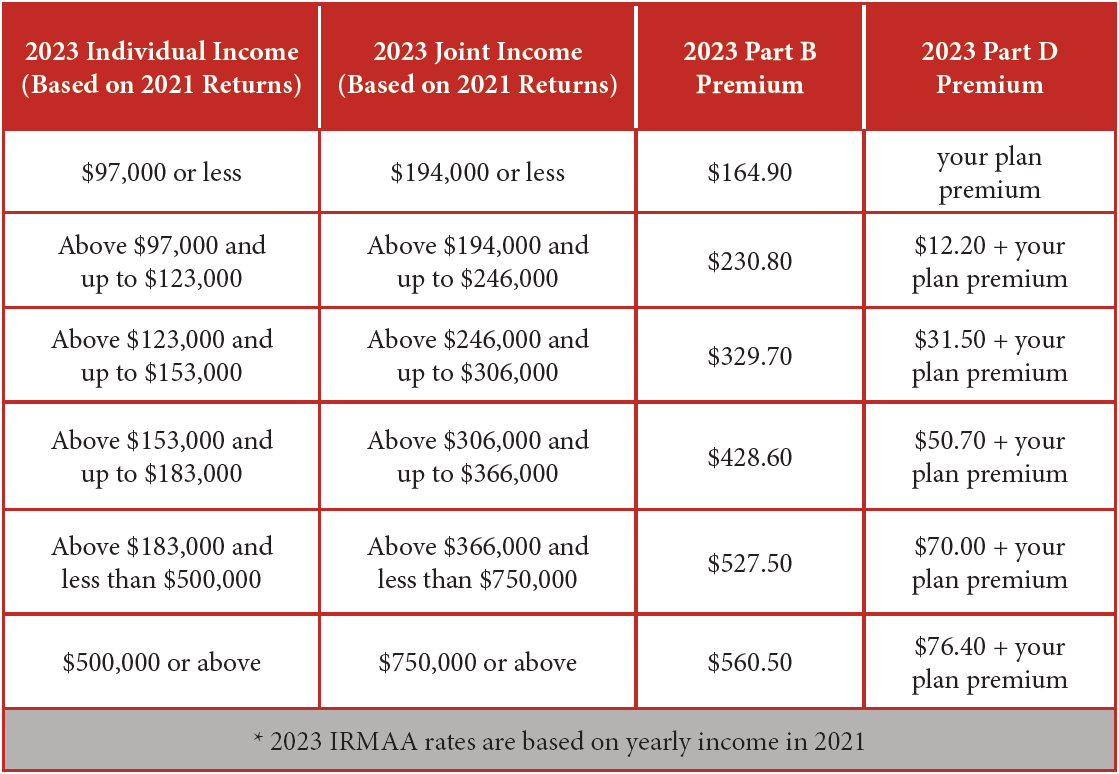

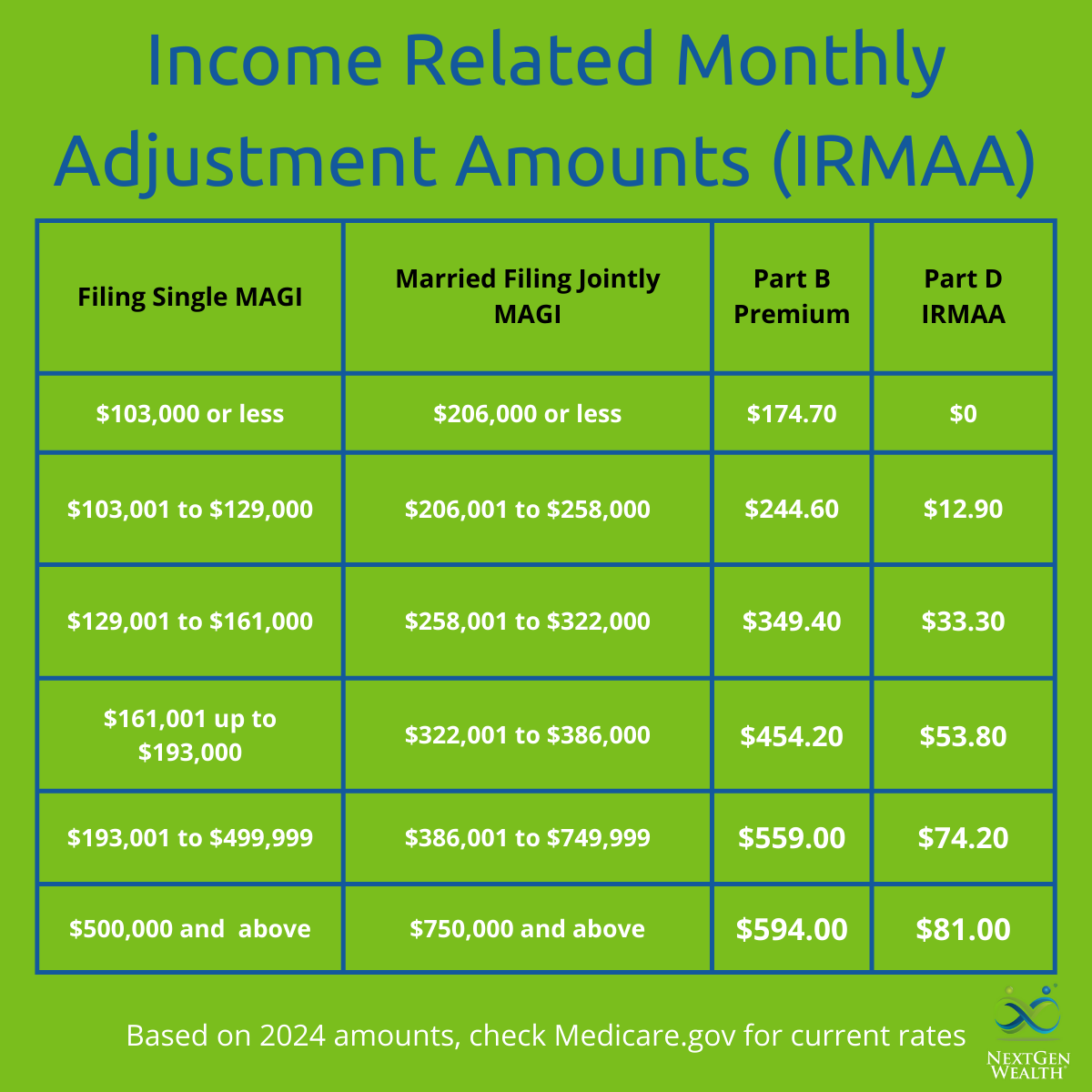

The Social Security Administration (SSA) uses the following income brackets to determine the IRMAA surcharge:

Individuals:

+ $88,000 or less: No surcharge

+ $88,001 - $111,000: $59.40 surcharge

+ $111,001 - $138,000: $148.50 surcharge

+ $138,001 - $165,000: $237.60 surcharge

+ $165,001 - $214,000: $326.70 surcharge

+ $214,001 or more: $415.80 surcharge

Joint Filers:

+ $176,000 or less: No surcharge

+ $176,001 - $222,000: $59.40 surcharge

+ $222,001 - $276,000: $148.50 surcharge

+ $276,001 - $330,000: $237.60 surcharge

+ $330,001 - $414,000: $326.70 surcharge

+ $414,001 or more: $415.80 surcharge

Surcharge Amounts for Part B and Part D

The surcharge amounts for Part B and Part D vary based on the income bracket and the type of coverage. The following tables outline the surcharge amounts for each:

Part B Surcharge Amounts:

| Income Bracket | Surcharge Amount |

| --- | --- |

| $88,001 - $111,000 | $59.40 |

| $111,001 - $138,000 | $148.50 |

| $138,001 - $165,000 | $237.60 |

| $165,001 - $214,000 | $326.70 |

| $214,001 or more | $415.80 |

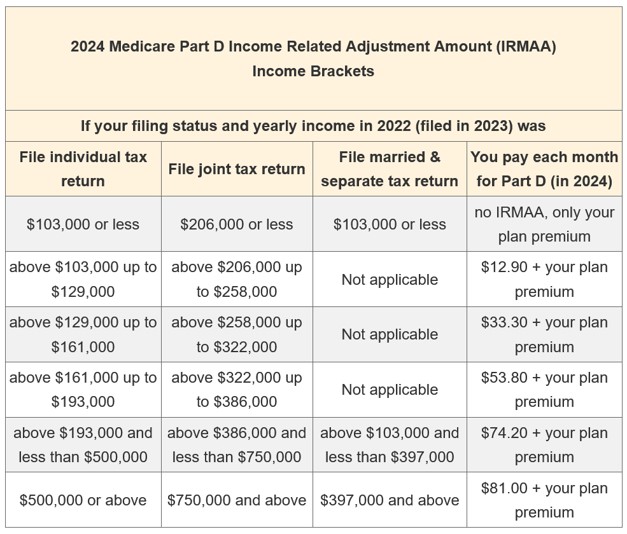

Part D Surcharge Amounts:

| Income Bracket | Surcharge Amount |

| --- | --- |

| $88,001 - $111,000 | $12.20 |

| $111,001 - $138,000 | $31.90 |

| $138,001 - $165,000 | $51.40 |

| $165,001 - $214,000 | $70.90 |

| $214,001 or more | $76.40 |

Understanding the PDF income brackets and surcharge amounts for Part B and Part D IRMAA is essential for Medicare beneficiaries with higher incomes. By familiarizing yourself with the income brackets and surcharge amounts, you can better plan for your Medicare expenses and avoid any unexpected financial burdens. Remember to review your income and adjust your Medicare coverage accordingly to ensure you're not paying more than you need to. If you have any questions or concerns, consult with a licensed insurance professional or contact the SSA for guidance.

Note: The information provided in this article is subject to change, and it's essential to verify the income brackets and surcharge amounts with the SSA or a licensed insurance professional for the most up-to-date information.